International Council of Shopping Centers (ICSC) Nexus R(etail) Evolution conference Recap

During the first week of January, Jim Dahlem attended the International Council of Shopping Centers (ICSC) Nexus R(etail) Evolution conference in Palm Beach, Florida. The conference, which focused on the evolution of business and the impact on retail real estate, was chock full of useful information.

Below, we hope you enjoy Jim’s recap of the two most impactful elements from the conference.

Disruptors

The business landscape is filled with disruptors or businesses that are shaking up the scene with innovations and unexpected models. One example would be the car service Uber, which recorded more volume than the entire cab industry by the end of 2016. Another example would be sensor technology.

Used in many devices that have shaped our daily lives in the 21st century, sensor technology is becoming better while also becoming less expensive to produce. We see this innovation in everything from golf gloves with attached swing analyzing sensors to the budding technology behind driverless cars. In fact, Waymo is already testing and deploying driverless cars, and they predict that by the end of this year, driverless cars with be prevalent in Phoenix, Arizona.

This is interesting, of course, but I’m sure by now you’re asking me what this has to do with commercial real estate. Well, let’s consider how Uber and Lyft might evolve as a result of these sensors. As of today, Uber and Lyft drivers pick up their customers and drop them off at a particular destination, but imagine a fleet of driverless cars performing the same service. Fewer people will require personal vehicles, leading to a reduced need for large parking lots in retail real estate.

Currently, there is an average of two parking spaces per automobile in the United States, however, it is estimated that by 2026 up to 95% of all vehicles will be driverless and owned by companies rather than individuals. The result will be a spike in disposable income due to family savings on vehicle ownership, and an urban landscape in our most populous cities that will need to be re-envisioned rapidly.

Brick and Mortar Retail is Dead, “Fake News,” or Lazy Journalism

The media is pressing the idea that brick and mortar retail real estate is dead, so let’s take a look at the facts.

Certainly, many retail concepts are currently shrinking their physical footprint, and it’s expected that some retailers will cease to exist. That is a natural cycle of all businesses. Additionally, new competitors such as Amazon.com are changing the landscape of retail business. It has been reported that e-commerce sales account for anywhere between?

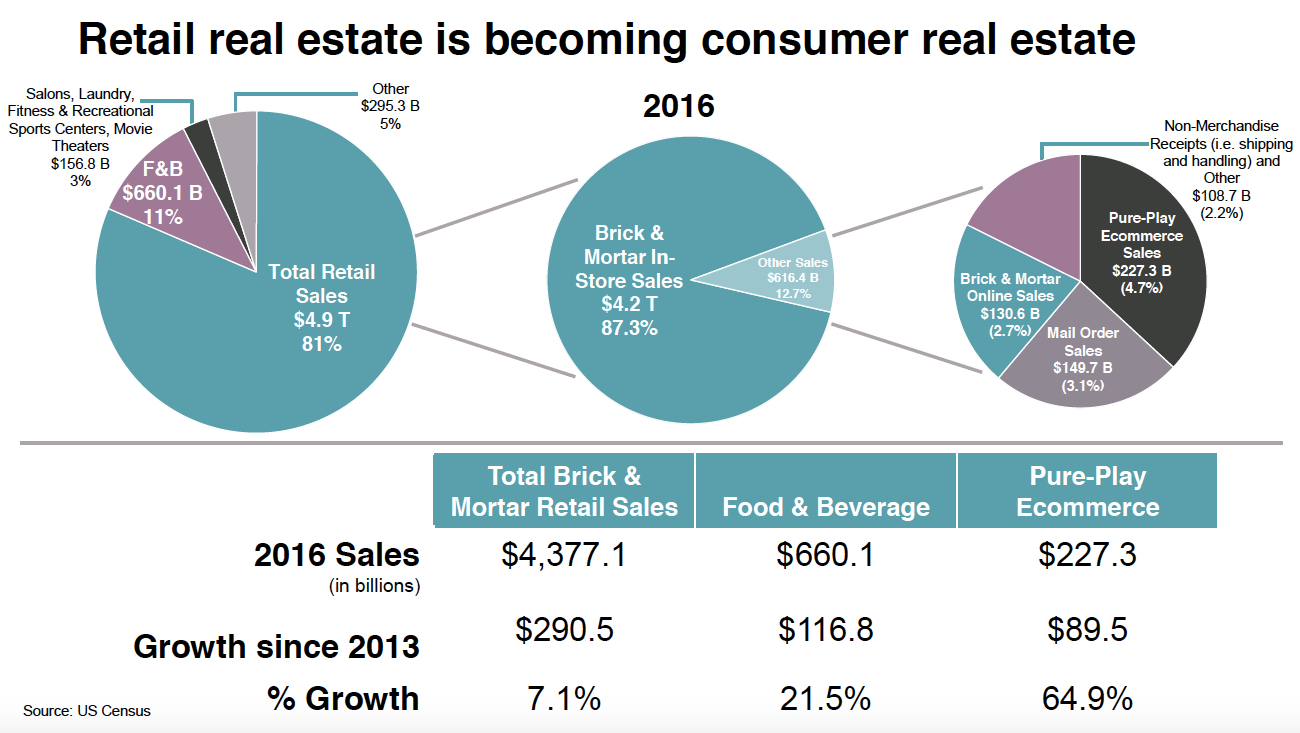

It’s important to dig into the numbers to see exactly how these numbers are derived. The chart below shows these numbers disaggregated to illustrate what is “pure play” e-commerce and what is not. Interestingly, pure-play e-commerce appears to represent only 4.7% of all retail sales.

Those of us in real estate shouldn’t underestimate the change that’s happening in our business, but it doesn’t ring the death knell for brick and mortar real retail real estate either. Statistics prove that if a retailer closes a store in a particular market, online sales suffer as well. Additionally, 90% of shoppers who have made a purchase online and elected to pick up their items in the store will purchase other items at the time of their pick up. In order to remain competitive, retailers will need to successfully adapt to omnichannel selling.

The Nexus conference contained far more information than what I’ve shared here, but these topics were some of my most important takeaways for the future of our business. If you’re a retail real estate professional, I’d highly recommend attending the conference next year as it is packed with excellent information. If you can’t make it, stay tuned and I’ll summarize the high points!